Investors may overlook these three portfolios for their small size, but they are among the top 10% of funds for alpha, volatility and consistent performance.

Large funds are often the first to grab investors attention, but smaller portfolios can sometimes go unnoticed despite beating their bigger counterparts.

In the IA UK Equity Income and IA UK All Companies sectors alone, Trustnet found these three funds with just over £250m in assets under management (AUM) that were among the highest ranking portfolios in the Investment Association (IA) universe.

While their small size may leave them overlooked, each of these funds garnered a five FE fundinfo Crown Rating – something only 10% of the thousands of funds on the market are awarded.

Funds with a full five-crown score must exemplify outstanding alpha, volatility and consistent performance over a three-year period to gain the rating.

Merian UK Equity Income

Size: £67.3m

Three Year Return: 71.7%

Running of the fund is outsourced to a team at Jupiter Asset Management (formerly the Merian Global Investors part of the business) headed up by Ed Meier, which has delivered a total return of 167.4% since it launched in 2018.

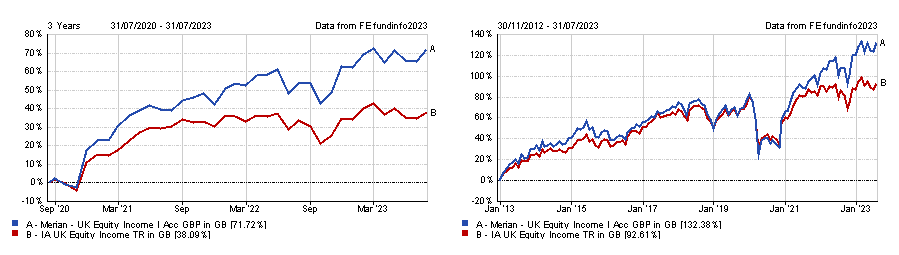

Though it may be small, this £68m fund beat the IA UK Equity Income sector by 39.8 percentage points since launching in 2012 with a total return of 132.4%.

Total return of fund vs sector over the past three years and since launch

Source: FE Analytics

Source: FE Analytics

Meier has devoted the highest individual sectoral allocations towards financials (19.6%) and consumer discretionary (19.2%), but energy and utilities companies jointly make up a sizable chunk of the portfolio (24%).

Drax, Centrica, Shell, BP and Diversified Energy account for half of the fund’s top 10 holdings, collectively worth almost a fifth (19.9%) of all assets.

VT Downing Unique Opportunities

Size: £47m

Three Year Return: 19.3%

VT Downing Unique Opportunities was the only fund on the list not only to have a five-crown rating, but an Alpha Manager at the helm – Rosemary Banyard.

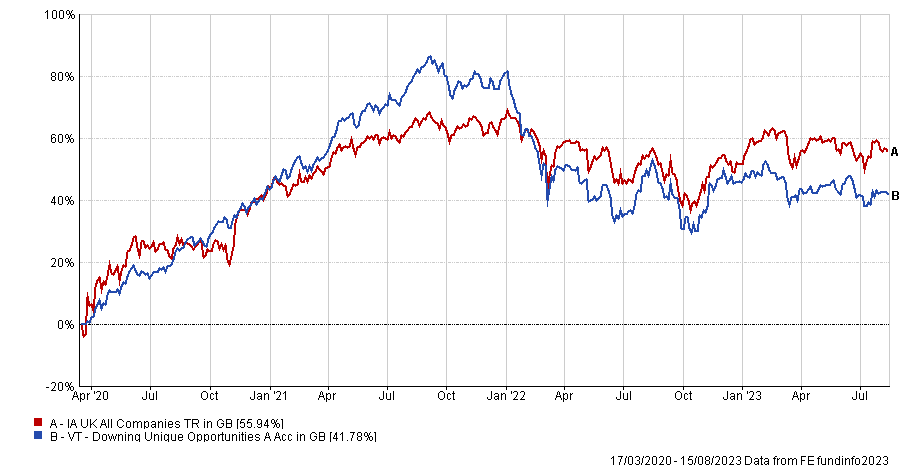

Total return of fund vs sector since launch

Source: FE Analytics

Source: FE Analytics

She launched the fund in March 2020, during which time it has delivered a total return of 41.8%. This is 14.2 percentage points behind the IA UK All Companies peer group, yet the fund’s strategy and Banyard’s track history have proven themselves to be ahead of the market.

Since 2000, she has delivered returns across her career of 707.8%, far above the 413.1% of her composite peer group during this time.

TM Crux UK Special Situations

Size: £139.7m

Three Year Return: 41.4%

The TM CRUX UK Special Situations Fund favours shares which it considers to be undervalued due to the specific situation of the relevant company, its group and/or any member of its group. It may be that the relevant company is subject to recovery action, management change, strong potential growth, is undervalued or is refinancing or it may hold assets which the Investment Manager considers to be undervalued. The Investment Manager is not restricted in its selection of investments for the Fund by any geographic or industry specialisation.

The investment objective of the Fund is to achieve long-term capital growth, which should be viewed as 5 years or longer.

* All these funds can be purchased on the FundsNetwork Platform.

Information reported by Tom Aylott, Trustnet, 17th August 2023.