ESG investing is a type of socially responsible investing that, in addition to providing financial returns for its stakeholders, aims to have a positive impact on the environment and mitigate continued damage to the planet. In addition to these considerations, ESG investing also focuses on ethically functional businesses which aim to have a valuable social contribution, as recognised by each respective fund manager. An example of this would be investment into businesses which have actively exhibited a stakeholder-backed effort to reduce carbon emissions and achieve net zero sustainability.

Funds in this category use a combination of positive and negative screening in order to pick stocks, mitigating the amount of investment into businesses which harm the environment. However, to some the concept of screening in favour of ESG-impactful businesses is risky and might result in losses as the cost-of-conscience restricts investors from investing in profitable businesses which have a detrimental impact on the environment. Consequently, a best-in-class approach is often used as a strategy to select investments which both exhibit a positive rate of return in addition to their constructive environmental impact. Therefore the cost-of-conscience is reduced, meaning investors can see healthy returns in addition to mitigating emissions or divesting into harmful businesses.

In addition to negating a potential cost-of-conscious, ESG investments have steadily risen in popularity of the past few years. Not only are governments and independent regulatory associations sustainably investing to reach the Paris Agreement’s 2050 net zero goal, but also private investors have increasingly set their sights on investing in ESG funds in order to align themselves to this cause.

Financially, there have been a number of positive outcomes from this shift. Firstly, an expanding roster of funds have been developed in order to provide investors with numerous options to either invest holistically or focus on a specific cause (e.g. investing in renewable energies). Secondly, as the world becomes increasingly reliant on reducing emissions, a greater amount of geo-political emphasis will be placed on businesses working to mitigate environmental damage. Therefore, public concern for sustainability alongside international governmental emphasis will potentially spearhead the value of such companies, helping to guarantee increasing returns over the years.

To that end, we have compiled a list of our favourite funds which invest in such causes as carbon emission mitigation and renewable energies in order to take advantage of this unique environment.

By Theodore Rouse

See our Positive Impact Portfolio

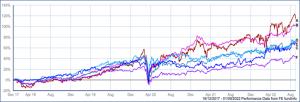

| Performance to 1/9/2022 Income reinvested | Yield % | Risk | 1 Year % | 2 Year % | 3 Years % | 5 Years % | |

| A | Ecofin Global Utilities & Infrastructure Trust | 3.07 | 150 | 28.8 | 51.1 | 76.1 | 117.0 |

| B | Gravis Clean Energy Income | 3.44 | 82 | 16.2 | 33.1 | 58.0 | – |

| C | M&G Global Listed Infrastructure | 2.12 | 93 | 12.6 | 31.1 | 27.0 | – |

| D | Greencoat UK Wind Plc | 4.52 | 50 | 33.4 | 27.6 | 37.3 | 74.9 |

| E | The Renewables Infrastructure Group Plc | 4.69 | 97 | 21.3 | 18.0 | 30.7 | 76.1 |

| F | Sector Average | 12.6 | 14.2 | 19.5 | 38.5 |

HIGHLIGHTED TRUST

Greencoat UK Wind Plc invests in operating UK wind farms to provide shareholders with a sustainable and transparent income stream through an annual dividend of 4.75%. Given the nature of the Company’s income streams, the board has increased and intends to continue to increase the dividend in line with retail price index (RPI) inflation. The Company also aims to preserve capital on a real basis by reinvesting excess cashflow in additional operating UK wind farms, and through prudent use of portfolio leverage.

The Company offers exposure to UK wind generation through a premium listed vehicle and is invested solely in operating onshore and offshore UK wind farms which are currently producing income.

The fund is a constituent of the FTSE 250 and has a market capitalisation of approximately £3.8 billion.